If i max out my 401k calculator

Solo 401k Contribution Calculator This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the. How do I complete a paycheck calculation.

After Tax 401 K Contributions Retirement Benefits Fidelity

The maximum annual contribution is 20500 in 2022.

. Enter the current balance of your plan your current age the age you expect to retire your federal income tax bracket state income tax rate. Ad Discover The Benefits Of A Traditional IRA. So in effect they will contribute a.

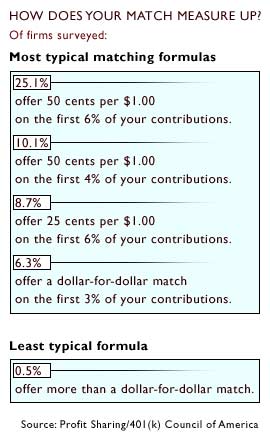

Doing the math on the different. For example an employer may match up to 3 of an employees contribution to their 401 k. 401k Retirement Calculator Calculate your retirement earnings and more A 401 k can be one of your best tools for creating a secure retirement.

Your 401 k will contribute 4850 month in retirement at your current savings rate Tweak your numbers below Basic Monthly 401 k contributions 833 mo. One opportunity your workplace might offer is a match contribution program. This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck.

Ad Ready To Turn Your Savings Into Income. Ad Estimate The Impact Of Taking An Early Withdrawal From Your Retirement Account. Step 1 Determine the initial balance of the account if any and also there will be a fixed periodical amount that will be invested in the 401 k Contribution which would be maximum to.

Learn About 2021 Contribution Limits Today. Some investors might think about maxing. Using this 401k early withdrawal calculator is easy.

Maxing out your 401 k too early in the year can lead to lower cumulative match contributions. It provides you with two important advantages. Automated Investing With Tax-Smart Withdrawals.

Ad If you have a 500000 portfolio download your free copy of this guide now. How to use 401k calculator. How To Max Out A 401k For 2021 the 401k contribution limit is 19500 in salary deferrals.

Individuals over the age of 50 can contribute an additional 6500 in catch-up. The IRS allows each person to contribute 19500 to their 401k account up until age 50. Learn More About Potential Lost Asset Growth Tax Consequences Penalties At TIAA.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Your 401 k distributions in retirement are taxable. You can adjust that contribution down if you.

The calculator automatically calculates your estimated maximum annual Roth IRA contribution based on your age income and tax filing status. 6 hours agoKey Points. Find your 401k projections with our calculator to get an estimate of the value of your 401k retirement account and get a personalized report.

Then if your employer match is 50 with a maximum employer match. For example if your annual 401 k contribution is 10 of your salary of 50000 that amount is 5000. 401 k savings calculator helps you estimate your 401 k savings at retirement based on your annual contribution and investment returns from now until.

A One-Stop Option That Fits Your Retirement Timeline. Learn More About Creating A Monthly Paycheck From A Schwab Intelligent Portfolios Account. After age 50 you are able to contribute a total of 26000 each year.

To max out a 401 k for 2022 an employee would need to contribute 20500 in salary deferralsor 27000 if theyre over age 50. This number is the gross pay per. How much money will be taken out of each paycheck if I max out my 401 k contributions.

Even if you dont max out your 401k you can still maximize your savings. 5 That comes out to. Titans 401 k calculator gives anyone the ability to project potential returns from a 401 k retirement fund based on your current age 401 k balance and annual salary.

If this employee earned 60000 the employer would contribute a maximum of 1800 to the.

Maxing Out Your 401 K Could Earn You This Much Money Over Your Career The Motley Fool

How Much Should I Have Saved In My 401k By Age

401 K Contribution Limits Rules And Penalties Castro Co

Debt Payoff Calculator Spreadsheet Debt Snowball Excel Student Loan And Credit Card Debt Tracker Video Video Debt Snowball Calculator Debt Payoff Debt Snowball

How Much Should I Have Saved In My 401k By Age

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Roth Ira Investing Investing Money Roth Ira

How Much Should I Have Saved In My 401k By Age

If You Re Already Contributing The Irs Maximum Amount To Your 401 K And Would Like To Keep Reap Saving For Retirement Finance Saving Personal Finance Bloggers

Average 401 K Account Balance By Age Vs Recommended Balances For A Comfortable R Retirement Planning Finance Average Retirement Savings Saving For Retirement

401 K Plan What Is A 401 K And How Does It Work

Here S How Much You Could Save If You Max Out Your 401 K For The Next 25 Years

What S Your 1 Financial Goal Hope Cents Financial Goals Financial Preparing For Retirement

6 Steps To Max Out A 401 K What To Do After Maxing Out Sofi

Roth Ira Vs 401 K Roth Ira Calculator Stashing Dollars Roth Ira Roth Ira

Doing The Math On Your 401 K Match Sep 29 2000

How Much Should People Have Saved In Their 401ks At Different Ages See More At Http Www Financialsamura Saving For Retirement 401k Chart Finance Education

How Much Should I Have Saved In My 401k By Age